By Amol Desai, CFP®, CFA

In the midst of our bustling lives, there are moments that bring back memories we never anticipated. The recent periods of high inflation and rising interest rates probably triggered my memories and transported me to the days of the 2008 financial crisis. Back then, I was a working engineer, and finance and economics were realms that I had never ventured into. This blog isn’t about dissecting the intricacies of money from an economic standpoint – I am not delving into how interest rates, money supply, velocity of money etc. work. Instead, it’s a recollection of my questions and thoughts about money back in 2008, viewed through the lens of a layman, which was precisely who I was at that time. Join me as I revisit those curious musings, and perhaps, together, we can gain a new perspective on the value of money.

The 2008 financial crisis was a time of turmoil and uncertainty. Media often used to describe it as a crisis of confidence in the financial system, and I found myself trying to make sense of it all with my meager knowledge of finance at that time.

I began to wonder, “What is money, anyway? Where does it derive its value from? What do they mean by credit crisis or crisis of confidence?” I started noticing that I get my salary deposited in my bank that gives me online access to my account. I could login to my account and see my balance whenever I wanted. But I never saw actual money-paper currency-handed over to me on the pay-day. Instead, I used to get a paystub as proof that the salary had been deposited to my bank account. Of course, I knew it was the same for everybody but I started to think why does everyone believe that they received the money? All that we can see is some number on our computer screen.

In the digital age, we routinely log in to our bank accounts, check investments, and manage credit cards—all through digital interfaces. It led me to ponder: why do we believe that the numbers we see on the screen represent actual money? Our paychecks are deposited electronically, and we only receive a digital paystub as acknowledgment. When we shop online and make payments with credit cards, both we and the seller have faith that money is exchanged, but how does this work?

No one sees the actual physical notes and coins. Everything is in digital form, and we trust it implicitly. Even in the era of traditional paper money, I wondered, why did we believe a simple piece of paper had value just because a number was printed on it?

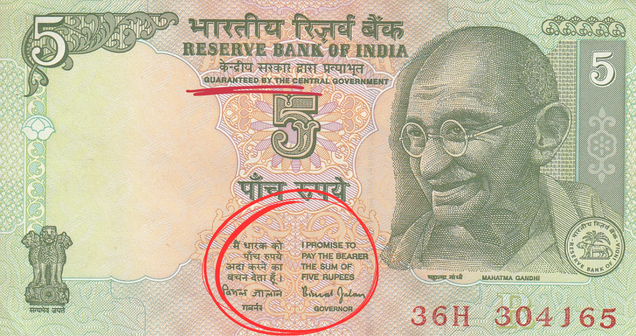

I couldn’t stop thinking about it, and the confusion lingered until the next morning when I had a Eureka moment. In the middle of the night, images of Indian currency notes flashed before my eyes -I grew up in India, and sometimes it is surprising how old memories can come to the fore unexpectedly. I recalled the promise by the Reserve Bank of India, with its governor’s signature, printed on each note. It suddenly became clear: money is credibility. We believe in its value because a central bank or a government authority of the land guarantees its worth.

Imagine a world where no one trusted this guarantee, where the promises on those pieces of paper were just plain words. Chaos would ensue, and money would have no value at all.

This realization provided me with a basic understanding of what money truly is and a different perspective on it. Instead of viewing money as a traditional representation of wealth, I began to see it as a token of trust and credibility.

The traditional view of money often leads to greed, fear, and anxiety about not having enough or, conversely, overconfidence and wastefulness when we perceive we have more than enough. This new paradigm of money as a token of trust and credibility can lead us to see it as a pure economic concept, a resource that requires intentional nurturing and conservation.

Think about trust and credibility in your personal life. In a society where trust is scarce, can meaningful relationships be formed? Trust is a resource that we all should strive to build. In our careers, as our credibility increases through education and experience, we become more valued, leading to increased responsibility and compensation.

The key takeaway here is not to view money through narrow, materialistic lenses as something to relentlessly chase. Instead, understand that money’s value primarily stems from the trust we have in the system. It’s a rough token of credibility.

Focus on building your own credibility and consider money as an economic concept and a potent resource to be carefully nurtured and intentionally managed. In a world where trust and credibility are the true currency, it’s time to start investing in yourself and the relationships you build. Money is more than just numbers on a screen; it’s a testament to trust and the credibility we carry in our lives.