Our Process and Fees

How We Help

Sometimes you feel overwhelmed by a myriad of information/suggestions from innumerable sources, making you uncertain about your financial circumstances or anxious about impending financial decisions that may define how you build a future for you and your loved ones.

Other times you are too busy with a demanding professional and personal life to meaningfully plan and manage your finances efficiently.

It does not have to be this overwhelming. Our collaborative process helps you develop clarity and confidence around your financial decisions.

It is YOUR plan and we become a guide on your journey toward your ideal life.

We facilitate your transition from being uncertain and anxious about your finances to becoming financially assured and well prepared for life.

Organize

Analyze

Optimize

Succeed

How Do You Start

Explore if we are a good fit

Schedule a complimentary 30-minute call or virtual meeting so we can hear more about what prompted you to seek professional guidance. We would love to answer questions you have for us!

Discuss Potential Path Forward

We again do a complimentary meeting of up to 60 minutes in which we present you a one-page summary of our preliminary analysis and recommended actions. This will also be another chance for us to understand each other better.

Start The Journey

We really appreciate the trust you put in us. Let’s begin your onboarding as a new client. We are as excited as you are to collaborate on your journey toward building long-term wealth.

Explore if we are a good fit

Schedule a complimentary 30-minute call or virtual meeting so we can hear more about what prompted you to seek professional guidance. We would love to answer questions you have for us!

We may ask you to share some basic relevant documents through a secure file-sharing system for us to review

Discuss Potential Path Forward

We again do a complimentary meeting of up to 60 minutes in which we present you a one-page summary of our preliminary analysis and recommended actions. This will also be another chance for us to understand each other better.

Here are a few questions you may ask yourself to help you decide.

- Does PWA listen to me and understand my concerns?

- Do I feel heard? Do I feel I can share my financial pain points (current and future) with PWA, without fear of being judged?

- Do I believe PWA will be able to provide great value to me in the long run?

- Is PWA trustworthy and credible?

Start The Journey

We really appreciate the trust you put in us. Let’s begin your onboarding as a new client. We are as excited as you are to collaborate on your journey toward building long-term wealth.

We may ask you to share some basic relevant documents through a secure file-sharing system for us to review

Here are a few questions you may ask yourself to help you decide.

- Does PWA listen to me and understand my concerns?

- Do I feel heard? Do I feel I can share my financial pain points (current and future) with PWA, without fear of being judged?

- Do I believe PWA will be able to provide great value to me in the long run?

- Is PWA trustworthy and credible?

Your Ongoing Journey—the PWA way!

Step 1:

Discover

Step 2:

Organize & Review

Step 3:

Create

Step 4:

Deliver

Step 5:

Ongoing Support

Cost to You

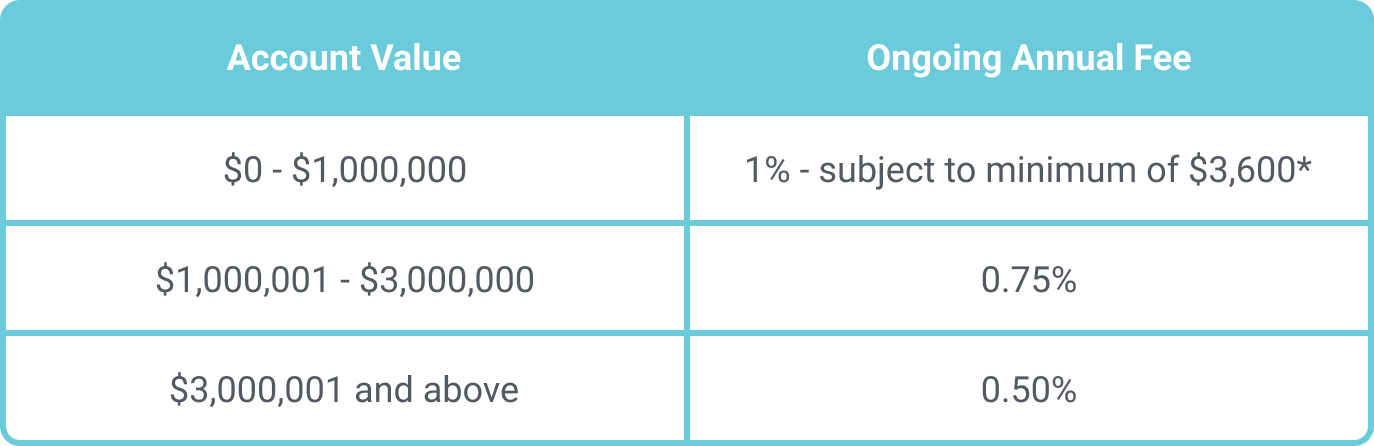

Comprehensive Financial Planning

Upfront Fee: Starts at $1500. May change based on complexity

*This is the minimum ongoing fee when we are not managing your assets or assets under management are not yet sufficient to generate this minimum fee.

The $3,600 stated here is an example; actual fee may be higher or lower based on complexity of client situation and their needs.

One-Time Plan development without ongoing guidance may be available starting at $3,000.

Needs-Based Hourly Consulting may be available upon request at $250/hour.

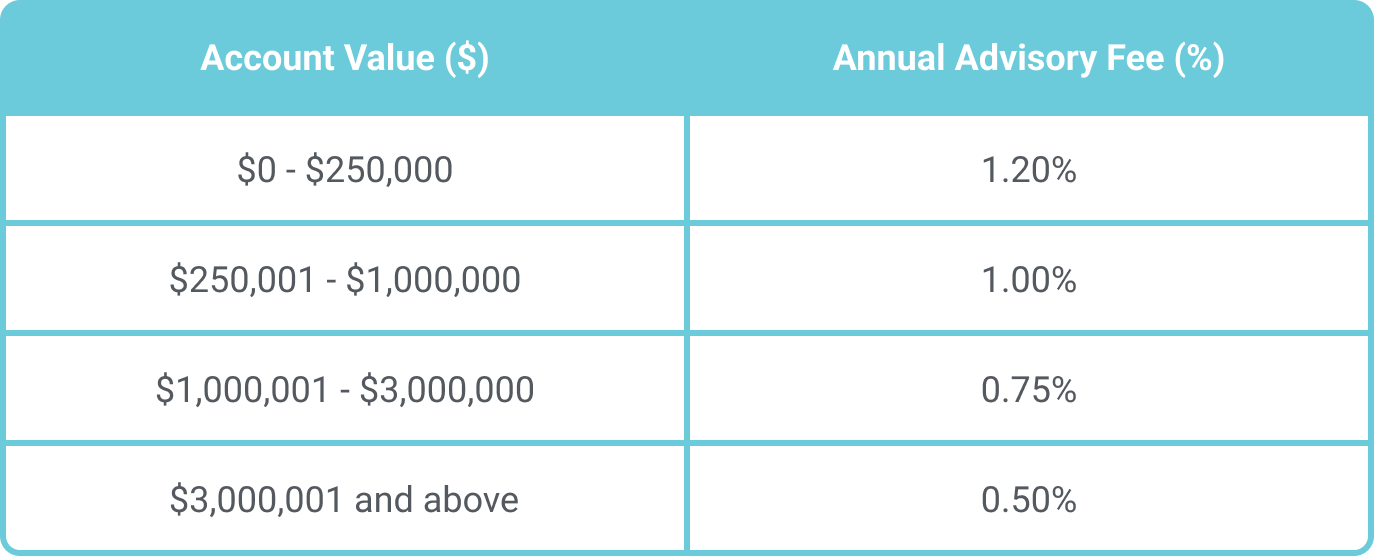

Investment Management: